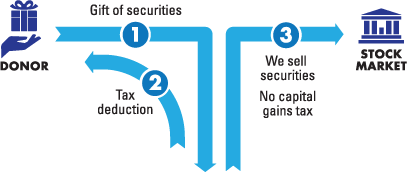

Gifts of Stock or Appreciated Securities

Take advantage of appreciated securities while avoiding capital gains tax by making a donation of your assets.

How It Works

- You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to Archmere Academy.

- Archmere Academy sells your securities and uses the proceeds for our programs.

Benefits

- You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer (even if you originally paid much less for them).

- You pay no capital gains tax on the transfer when the stock is sold.

- Giving appreciated stock can be more beneficial than giving cash. The "cost" of your gift is often less than the deduction you gain by making it.

Next

- Frequently asked questions on gifts of stock.

- Contact us so we can assist you through every step.